According a report by www.quora.com <https://www.quora.com/>, there are a number of reasons why a person may have multiple accounts and multiple financial institutions.

*Personal account

This is usually an account where you put your own money. This could be a place where you receive direct deposit.

*Joint account/Custodial account

Joint account: This is an account that is accessible by two or more people. The account owners will have equal access to the account to deposit and withdraw money. Some couples use joint accounts; also, parents and their adult children may want joint accounts.

* Trust account

This is a special account for those who have trusts. It is different from regular personal checking accounts or any joint accounts.

If you’re asking why someone would have multiple banks, for example; your spouse may have a different bank with a better joint account package fit for you two, so you may have the joint account at that bank.

Custodial account: This is for people who want to open accounts for children, usually their own children, grandchildren, nieces, nephews, etc. who are under the age of 18. This is to start saving money for the children. Sometimes, they want to teach the children how to manage money. An adult must operate this account; can withdraw and deposit in the account.

* Interest rates

An interest rate can be enticing, especially for a savings account and other accounts.

*Types of banking products

You may have multiple banks because of rewards offered by the banks or accounts. The bank may reward you with a better interest rate or points because of a certain bank account you have (this usually is tied to the amount you keep in your account, the higher, the better). If you have a lot of liquid asset, it will be easy to take advantage of multiple banks and their promotional offers and reward packages.

*Bank versus credit union

Banks are owned by corporations where credit unions are owned by its members. Credit unions are more local, but compared to big banks, they usually have less and lower fees. Credit unions also offer different products. Depending on your needs, you may have a bank or a credit union or both.

* Ease of access

Maybe you’re living in New York in the summer, and your bank in Oklahoma does not have a presence in New York. To avoid the ATM fees or whatever it may be, you may open a bank account in a bank in New York.

*Personal preference

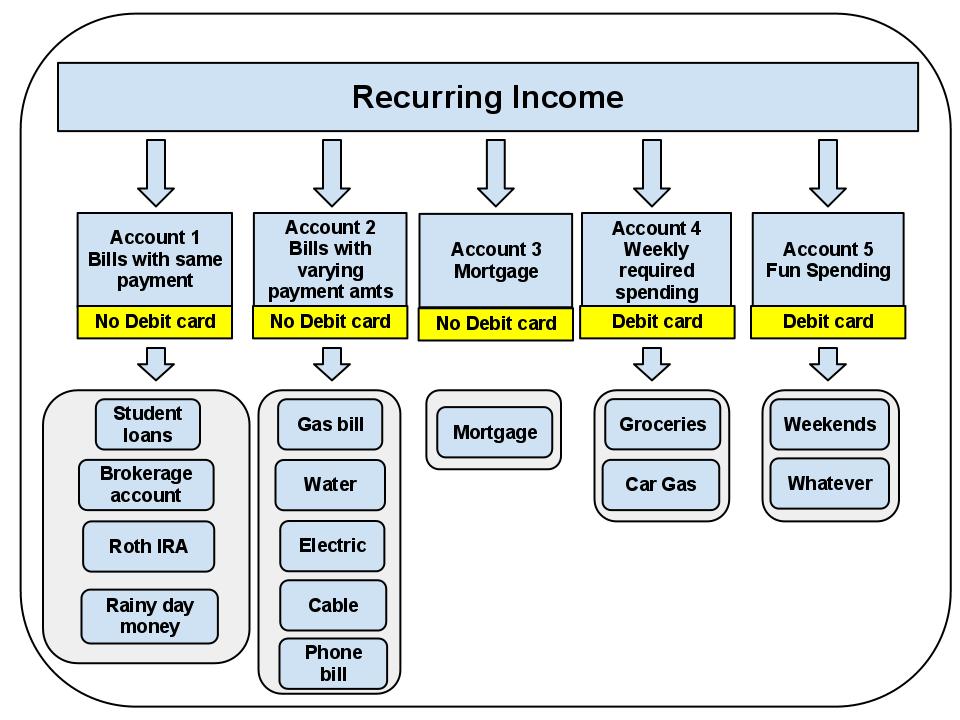

For some people, the way to take care of their bills and finances is to split them into separate bank accounts. They could then see how much money is saved and how much money is budgeted for them to spend ( for kid’s clothes, college funds, home improvements, etc).