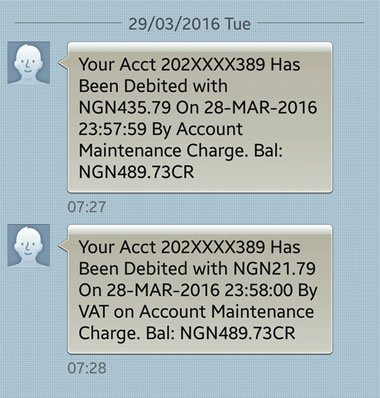

Roland Agboye’s face turned red when he flipped through the text messages his bank sent him that Tuesday morning.

He had turned off the lights and was about sleeping — his wife on his left side in the bed and his phone on his right side — when his phone beeped for two consecutive times.

He entered his phone’s passcode and the messages stared him in the face.

“Your account has been debited with N190.12 by account maintenance charge,” the first message sent to him at 12:46am on June 28, 2016 read.

The second followed, “Your account has been debited with N9.51 by VAT on account maintenance charge.”

Although Agboye had always been receiving monthly notifications of deductions from his bank, his anger that morning was because he had exactly N10,000 in his account and had planned to use the exact amount on a purchase as soon as the day broke.

“I had never kept vigil on how much I had in my bank account. My bank always deducts from my account every month and I have never cared, but I had budgeted to use the exact amount to buy something in the house that Tuesday,” he said. “But the deduction of that N200 altered my plan. I wouldn’t have observed that they had deducted my money again, but I was broke. These days, I try to account for every kobo that leaves my pocket. Times are a bit hard.”

Between January and June of this year, Agboye has lost N3,068.35 to his bank as charges on all transactions, a total of monthly deductions sent to his phone showed.

Baffled why his bank doesn’t usually credit his account with figures as “high” as the ones they debit, he concluded, “Banks are not friends. They rip us off.”

In the log of messages shown to our correspondent, the only credit notification Agboye has received this year read, “Your account has been credited with N1.92 by POS-CBN EPIS loyalty programme.”

“But what is N1.92 credit compared with a debit of N3,068.35? Is that not robbery?” he asked a question some other bank customers are asking.

If it were possible, she wouldn’t save her money in the bank, but the risk of keeping money at home or in her shop means that she needs to go to the bank at least twice in a week to save.

She gets no interest on her savings but she keeps receiving notifications of deductions by way of account maintenance charge and value added tax on the account maintenance charge.

A textiles trader on Lagos Island, Mrs. Omobunmi Johnson, said, “The risk of keeping money in the shop or in the house is the reason I go to the bank. Otherwise, there is nothing they offer that is spectacular. I get monthly deductions by way of account maintenance charge. Then, they send another notification that they have deducted VAT on account maintenance charge.

“Please, what is it that they are maintaining in my account? Does my money require any maintenance? I just don’t understand. I used to ignore the amounts deducted, but I have recently developed interest in knowing what happens to my account.

“Apart from the maintenance charges, they also deduct SMS alert charges and others that I can’t remember very well. When I confronted them recently, they said it was because I was withdrawing more than three times from my account. I was mad. I felt like, ‘Is it not my money? Who are you to dictate how I spend my money?’ I was so mad that day that I felt I should close my bank account, but where else would I keep it?”

Since there was no other alternative for her, Johnson has accepted her fate. This implies that her bank will keep deducting as they ‘maintain’ her account.

Some other bank customers who spoke to our correspondent said they could not fathom why they had to lose their money for choosing to save in banks.

From SMS alert charges, to charges on automated teller machine and online transfers, to account maintenance charge, and VAT on account maintenance charge, commercial banks in the country have developed “multiple streams of income” in ripping off their customers.

“I spend an extra N107 each time I transfer funds online from my bank account to other banks, on just one transaction. Now if I have to transfer to 10 people, I would be spending N1,070. Isn’t that insane? Why is the banking system designed to rip us off?” an economist, Oluwadaisi Babatunde, asked.

He added that whether he carries out transactions on his account or not, he gets a monthly deduction notification from his bank, ranging from N10 to N20.

“I assume they think money grows on trees. If not, they wouldn’t be treating me this way,” the economist said.

An expert in banking, Looqman Oriade, told our correspondent in a LinkedIn message that there is usually a monthly limit on withdrawals being made by bank customers.

He said, “Exceeding the limit means they will penalise you by deducting from your account. The more you withdraw above the limit, the more you pay. Banks want you to allow them to use your money to do business, so if you are always withdrawing, they believe you don’t want them to make money.

“Because you don’t want them to make money, they can’t give you any interest. It’s like a Yoruba proverb which says, ‘The child that says his mother will not sleep, then he too will not sleep.’ If a customer says he doesn’t want his bank to make money by withdrawing every now and then, then he too will not be treated nicely by the bank.

“Most of the money in our economy is created by banks, in the form of bank deposits. Banks create new money whenever they make loans. 97 per cent of the money in the economy today is created by banks, while just 3 per cent is created by the government.

“Every new loan that a bank makes creates new money. While this is often hard to believe at first, it’s common knowledge to the people that manage the banking system.”

Be that as it may, George Nicolas, a petrochemical engineer in Port Harcourt, Rivers State, said he had to close two out of his three bank accounts recently because of the “insane” charges.

He told our correspondent via Facebook chat, “I have never bothered myself with the multiple charges, until recently. I think it’s because of the harsh economy we’re in. I am very vigilant of every dime I spend these days. So when I discovered that so many incomprehensible deductions are being made by all the banks where I had accounts, I had to close two and retain one.

“By having one account now, at least I will be able to save some money. Now, it annoys me when they say there’s a limit on withdrawals. It’s my money and I can take it anytime I want. The banks should just look for another means of making money.”

A student, Natein Obordor, said it was frustrating that her bank deducts from her monthly pocket money.

“Why should a bank rip off its customers? For me, as a student, these unreasonable charges are insane. How do you want me to survive? I’m considering closing my account and God help them they put me through trouble when I want to close it, that is when they will know the agony of a Nigerian student,” she said.

An accountant by profession, Mr. Gbenga Oni, also said banks ought to stop the “insane” deductions of customers’ money.

He said, “Times are a bit tough now, but I believe everything will be okay. When someone is broke, there is a degree to which you want to know what happens to every kobo you own.

“The economic condition is not too good. Many companies are not paying regularly again due to this. The banks too are affected. But while they make their money off us, they ought to be careful not to do it insanely.”

Banks facing hard times, so are customers

Almost all the people who spoke to our correspondent rarely cared what happened to their accounts in times past.

But they do now.

One of them, a businesswoman in Abeokuta, Ogun State, Mrs. Sade Akinpelu, confirmed this.

She said, “I used to get these deduction notifications before, but I didn’t ever care as long as I was rich. But I’ve been broke of recent, right from the beginning of the year, and this has made me turn aggressive a bit.

“When my bank used to debit me with amounts as high as N500 on monthly basis, I rarely noticed. I never bothered as long as there was much money in my account.

“But the economy has changed and I have to change with it. The price of fuel has gone up, food prices have increased, service fees have skyrocketed. These mean I spend more than before. If my bank, coupled with all these, are also making life unbearable, then it is worth driving me crazy.

“I write a budget for every dime I make these days. It was unlike me before. Now I have become an emergency accountant-cum-economist. It’s needed these days so I can survive.”

Some banking analysts suggested that the multiple charges levied on customers could have been a way for the banks themselves to survive the present economic period.

On June 13, 2016, it was reported that the harsh economic condition facing the country had led to a drastic reduction in customers’ deposits in banks, with the industry recording a decline of about N1.03tn in total deposit between April 2015 and April 2016.

To check this, the Bankers’ Committee reportedly sent a proposal to the Central Bank of Nigeria to limit across-the-counter withdrawals to N10,000, a move that was said to be considered by the apex bank through the Banking and Payment Systems Department.

The banking sector also recorded a decline of N154bn in total assets within the period, from N27.58tn in April 2015 to N27.43tn in April 2016.

“Considering their losses, the banks have probably resorted to deducting their customers’ funds ‘stylishly’ so as to survive the hard times,” a Lagos-based analyst, Boye Oni, told our correspondents.

A banking expert, Rislanudeeen Muhammed, opined recently that banks had always engaged in “arms-chair lazy banking” and that it was high time they started to operate as “real” banks.

“The banks need to appreciate the reality of where they are now. They need to begin to operate as banks because hitherto, there had been what I call arms-chair lazy banking. A worker could generate deposits and be promoted, forgetting that most of the employees don’t have a good understanding of the banking system. Now is the opportunity for real banking to emerge rather than the liability generation banking that we currently have,” he said.

‘If you don’t ask, they don’t tell’

Mr. David Badejo, a real estate developer who lives on Victoria Island in Lagos, said if he were to be in the United States or any other developed country, he would have sued one of the banks where he had an account for converting his savings account to a current account without informing him first.

He said, “This happened in January this year. I had left N25,000 in the said account since last year. It was a savings account. Before I knew what was happening, I was receiving debit transactions from it up to N300. Meanwhile, I didn’t carry out any transaction on it. I had to go to the bank.

“I confronted them and demanded why they were deducting my money without carrying out any transaction on the account. The customer care lady I met had to check my account and said it was because it’s a current account. I was furious.

“I had to create a scene. I asked why my savings account had to be converted to a current one without my consent. Their manager had to come out of his office to plead with me. That very day, they converted it back to savings for me after a series of apology. The following week, I closed the account.”

Badejo would not be the only person to experience the rip off on his account for letting it stay idle.

“In the olden days, if no transaction occurred on an account, for say six months, the account would become dormant and the owner would have to write the bank to reactivate it. Today, the policy remains, but the banks render it ineffective because they keep the account alive by adding just N2 monthly interest and deducting over N100 monthly maintenance charge,” an Enugu-based businessman, Emma Onoja, lamented, adding, “I have not carried out any transaction on one of my bank accounts in the last eight months, but I have kept receiving transaction alerts — N2 interest, N100 monthly account maintenance charge, plus SMS charges. Any system that extorts the poor to make a few people richer is corrupt.”

Banking professionals are not programmed to always reveal any policy that would rob their employers of money.

“One of the philosophies we live by is that if customers don’t ask us anything, we shouldn’t tell,” a bank official who spoke on condition of anonymity said, adding, “Customers should learn to challenge any bank that debits outside of what the CBN policies say. They will refund you immediately. It’s when you keep quiet that they keep on ripping you off.”

A banking expert, Mariel Leibowitz, also said in a Business Insider article, “Secrets banks don’t want you to know,” that customers needed to know certain things that their banks would probably never disclose to them.

He said, “First, banks want you to walk in to their branches. When you walk into a branch, the teller seems delighted to see you, but don’t be fooled, there’s more to it than that. Tellers always seem to be pushing for you to open new accounts, but that’s because their jobs depend on it. They are salespeople and have quotas to meet. Each new account you open means they will receive commission. Tellers are also required to send a certain amount of customers to the personal bankers at their desk. The biggest commission bankers receive is on large deposit accounts.

“Second, the more you swipe, the more they make. Every time you swipe your card, whether it’s debit or credit, the bank is making money from charging the merchant certain fees. Promotional credit card offers will often want you to spend a certain amount within a time frame in order to be rewarded. Although it’s a great deal for you, they are doing that for their benefit. The more you spend swiping your card, the quicker the banks make their money back from “rewarding” you.

“Third, a closed checking account can come back to haunt you. When you close a checking account, you assume that’s it. Well, that may not be the case. There have been instances in which customers closed their checking account, but forgot to switch over their autopay transactions, which caused their “closed” account to be charged anyway. This resulted in customers having to pay fees, penalties and in some cases were even turned over to collection agencies.”

A public affairs commentator in Ibadan, Oyo State, Abimbola Adegoke, said the CBN has a duty of protecting customers from banks’ multiple charges.

She said, “The CBN should stop treating the banks with kid gloves on the issue of illegal deductions. That the practice has continued among the banks is a testimony that the current CBN’s measures are ineffective.

“Banks should be profitable, but should not be driven by the overweening ambition to be excessively more profitable than the people and organisations they serve to the point of desperation. After all, they have no money of their own or products. It is the money of individuals and organisations that they keep in trust.”

Banks argue that the fees being deducted by them are to cater for the services they provide to the customers.

“The services we provide to customers are not for free. We keep their money for them, make it possible for them to sit on the couch and transfer or receive money from any part of the world. We need to be paid,” a banking official with one of the new generation banks told Saturday PUNCH.

The CBN spokesperson, Mr. Isaac Okoroafor, said the apex bank does not allow banks to rip off their customers.

“We protect customers from sharp practices by banks,” he said.

However, he said there was nowhere in the world where banks offer services for free.

He said, “But as a regulator, we do not allow the banks to make exorbitant charges. That is why we introduced a guide to bank charges in 2013 and eradicated Commission on Turnover which used to be deducted by banks.

“Because of the increase in the number of complaints we received from customers, we drafted another guide to bank charges which was posted on our website and we invited the general public to lend their voices to it.

“So now, if you feel your bank has charged you exorbitantly, go to the bank and make a complaint. Draw their attention to it. You can also ask for refund if you know it’s above the CBN-recommended rates which are available on our website.

“If they don’t do that within two weeks, write to the Consumers Protection Unit of the CBN and we’ll take it up. We don’t encourage banks to rip off customers.

“However, Nigerians should know that there is no part of the world where banks offer services for free. The system can’t work if they do that. They too have to be remunerated for providing services. But we will ensure that they are not allowed to make unfair or illegal charges.”